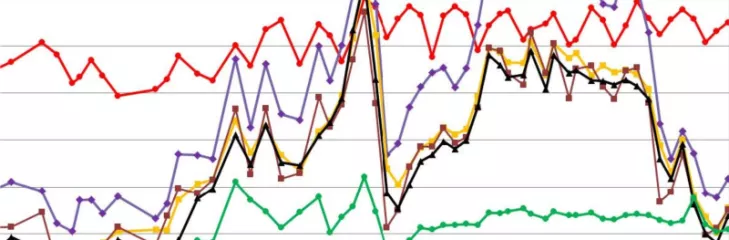

Last year, electric vehicles accounted for barely 4% of worldwide automobile sales. However, according to a study conducted by management consulting firm Roland Berger, this value will exceed 30% by 2030. Such a surge in demand creates additional concerns for the lithium-ion battery supply chain, particularly raw material availability.

"Batteries play a critical role in electromobility. However, their costs are highly dependent on the cell technology used, the manufacturing location, and, to a considerable extent, raw material prices," explains Wolfgang Bernhart, Partner at Roland Berger. "Increased raw material costs have already driven up the price of electric car batteries significantly in recent months. The conflict in Ukraine exacerbates this trend. This will not halt the march toward electric vehicles, but it will help to moderate it."

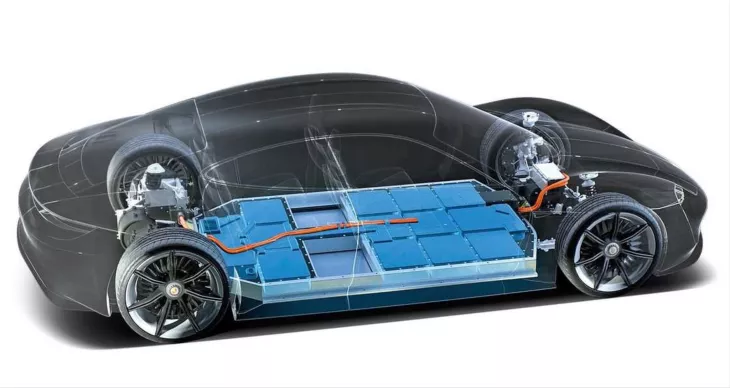

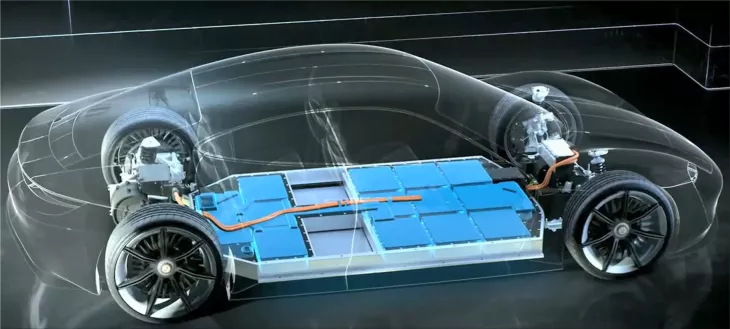

The experts forecast that the worldwide market for lithium-ion batteries will increase by 30% annually through 2030. Supply chains are being put under significant strain due to increased production. Above all, it is necessary to rely on certain raw materials and refined products such as cobalt and nickel sulfates and lithium. These materials account for more than 30% of the cost of a battery cell; the cells account for around 75% of the price of a battery pack.

Roland Berger has identified four significant risk areas in the supply chain:

Geopolitical Factors: Lithium mining and processing are concentrated in a small number of nations. For example, around a tenth of nickel came from Russia due to significant price shocks in raw material markets at the start of the combat.

Environmental, social, and governmental considerations: The manufacture of batteries has significant ecological and societal consequences. Lithium extraction requires a considerable quantity of water, and some manufacturing methods release substantial amounts of CO2.

Price: In addition to variable raw material prices, the expenses associated with expanding manufacturing capacity throughout the "mines to cells" value chain should be considered. Roland Berger anticipates a capital demand of 250 to 300 billion euros over the next eight years, one-third of which will be spent to meet European criteria.

Supply: Certain commodities are getting increasingly scarce. Temporary and long-term bottlenecks are expected with nickel and cobalt or their sulfates, particularly lithium.

According to the experts, modifications must be made across the supply chain to minimize these bottlenecks. "At the manufacturing level, a combined approach of metallurgy and chemistry may help cut costs," Bernhart explains. "Additional regionalization and cooperative site selection for multiple stages of battery manufacturing can also help mitigate geopolitical and environmental concerns." Additionally, recycling will play a more significant role by the decade's conclusion."

According to Roland Berger, as regulatory constraints grow, enterprises across the value chain will increasingly feel compelled to adopt a circular economy approach to battery manufacturing. Batteries' theoretically recyclable materials aided in satisfying the growing demand. "Automotive and battery manufacturers can also get more involved in upstream supply chains from a strategic standpoint. This might include everything from long-term supply agreements to joint ventures and investments," Bernhart explains. "Secure positioning at all crucial locations throughout the supply chain is time-consuming and costly, but it will provide a significant competitive edge."